If you are a Zimbabwean with a mobile phone, chances are high that you’re connected through Econet Wireless. The latest figures from the Postal and Telecommunications Regulatory Authority of Zimbabwe (POTRAZ) for the fourth quarter of 2024 continue to paint a picture of a company with a massive footprint in the nation's telecommunications landscape. But how big is Econet really? How did it get here? And what does its dominance mean for you, the everyday user, and for the future of mobile services in Zimbabwe? Let’s break it down.

Econet by the Numbers: A Clear Market Leader

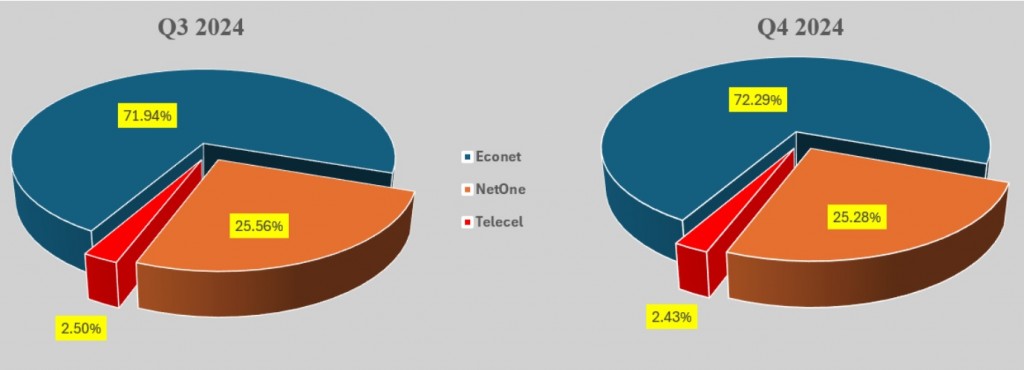

The POTRAZ Q4 2024 report leaves little doubt about Econet’s commanding position:

- Subscribers: Econet holds a staggering 72.29% of the mobile subscriber market share, with 11.33 million active subscriptions out of a national total of 15.67 million. This is a slight increase from the previous quarter, showing continued growth. In comparison, NetOne holds 25.28% and Telecel has 2.43%.

- Voice Calls: When it comes to making calls, Econet is the network of choice for the vast majority. It commands an overwhelming 88.61% of the mobile voice traffic market share. This means out of the nearly 4 billion minutes of national mobile voice calls made in the last quarter of 2024, over 3.5 billion were on Econet’s network. This share also saw an increase, while its competitors saw their voice traffic shares decline.

- Data Usage: In the ever-growing world of internet data, Econet also leads significantly. It accounts for 78.63% of all mobile internet data traffic in Zimbabwe. Out of the 97.19 Petabytes of data consumed nationally in Q4 2024, a whopping 76.43 Petabytes were used by Econet subscribers. This share also grew, indicating that Econet users are heavily driving the nation's data consumption boom.

These numbers clearly show that Econet isn't just a major player; it's the dominant force across all key mobile service segments in Zimbabwe.

What Does Econet’s Dominance Mean for You?

Econet's large market share has several implications for consumers:

- Network Reach and Quality: A large subscriber base often allows a company to invest more in network infrastructure. Econet has historically prided itself on extensive coverage, and its continued investment (including in 5G, with POTRAZ noting an increase in 5G base stations) aims to maintain this. For users, this can mean better connectivity in more places.

- The Network Effect: With so many people on Econet, calling other Econet users (net-on-net calls) is often cheaper and more seamless. The POTRAZ report highlighted that net-on-net voice traffic grew significantly by 49.81%, forming the bulk of the overall voice traffic increase. This creates a natural incentive for people to join and stay on the network their friends and family use.

- Innovation and Bundled Services: Dominant players often have the resources to innovate and offer a wider range of services. Econet has been at the forefront of introducing new products, from data bundles to value-added services and, crucially, mobile money.

- Pricing and Competition Concerns: On the flip side, a highly dominant market player can raise concerns about competition and pricing. While POTRAZ regulates tariffs, the level of competition can influence how aggressively companies price their services. Consumers often benefit most when there are several strong players vying for their business.

A Brief History: How Econet Grew to Dominate

Econet’s journey to market leadership wasn't accidental. Launched on July 10, 1998, and listed on the Zimbabwe Stock Exchange shortly after, the company faced a challenging environment.

- Early Mover & Innovation: Econet was a pioneer in many respects. It was the first operator in Zimbabwe to launch 3G data services in 2009, a crucial step in enabling the mobile internet boom.

- Aggressive Network Expansion: From its early days, Econet focused on building out its network infrastructure, including an extensive fibre optic network starting in 2009. This commitment to coverage gave it an edge, particularly in reaching more parts of the country.

- The EcoCash Revolution: Perhaps Econet’s most transformative innovation was the launch of EcoCash around 2011. In a country facing cash shortages and with a large unbanked population, EcoCash rapidly became the de facto mobile payment system, deeply embedding Econet into the daily financial lives of millions of Zimbabweans. This created immense customer loyalty and a powerful ecosystem.

- Strategic Investments: Econet has also made strategic investments in related sectors, such as its historical association with Liquid Telecom (now Liquid Intelligent Technologies), a major internet service provider. This has helped solidify its position in the broader digital ecosystem.

- Responding to Consumer Needs: The company has generally been adept at understanding and responding to the evolving needs of Zimbabwean consumers, offering a variety of service packages and data bundles.

Over the years, through a combination of technological foresight, strategic investment, and impactful innovations like EcoCash, Econet steadily grew its market share, often outpacing its state-owned and other private competitors.

The Future of Mobile Market Share in Zimbabwe: Is Econet a Monopoly in the Making?

With such a dominant position, the question of whether Econet could become a monopoly, or effectively already operates as one in certain segments, is valid.

- Current Situation: While Econet has a very high market share, it is not a pure monopoly as NetOne and Telecel still operate and provide competition, however limited their current share. POTRAZ, as the regulator, plays a crucial role in ensuring fair competition and protecting consumer interests.

- Challenges for Competitors: NetOne, despite being state-owned, and Telecel have struggled to significantly dent Econet’s dominance. This could be due to various factors, including historical investment levels, innovation pace, and the strong network effect Econet enjoys.

- The Role of New Technologies: The introduction of new technologies like 5G and the arrival of Low Earth Orbit (LEO) satellite internet services (like Starlink, mentioned in the POTRAZ report for its impact on VSAT subscriptions) could potentially shift market dynamics. However, Econet is also actively investing in 5G.

- Regulatory Oversight: The future market structure will heavily depend on regulatory policies. Regulators often aim to foster a competitive environment to benefit consumers. Measures could include asymmetric regulation (different rules for dominant players) or policies to encourage infrastructure sharing, though these are complex.

- Consumer Choice and Affordability: Ultimately, consumers will gravitate towards services that offer the best value, coverage, and quality. If competitors can offer compelling alternatives, they could chip away at Econet’s share. However, overcoming Econet’s entrenched position and brand loyalty is a significant challenge.

Predicting the future is difficult, but Econet’s current trajectory suggests it will likely remain the dominant player for the foreseeable future. Achieving a pure monopoly would likely face regulatory hurdles. However, maintaining its very high market share seems probable unless there are significant shifts in technology, regulation, or competitive strategies from NetOne and Telecel.

Econet's story is one of remarkable growth and innovation in the Zimbabwean context. Its current market share is a testament to its past strategies. For Zimbabweans, this means relying on a network that has shaped much of the country's digital journey, while also hoping for a competitive and innovative future that continues to deliver value for all.

Join WhatsApp Channel

Stay up-to-date with the latest technology news and trends by joining our exclusive WhatsApp channel! Get instant access to breaking news, insightful articles

TechNews

TechNews

Please login or create account to comment.